| |

US spending up, income up, prices up, manufacturing up, but Fed not worked up

at 2006-05-02 21:44:03

Yesterday's data gave little indication that the US economy is cooling. Reuters reports the news on consumer spending and income:

In Monday's first report, the Commerce Department said consumer spending rose 0.6 percent in March as incomes jumped, although much of the gain was eroded by the pickup in inflation.

The price index for consumer spending shot up 0.4 percent, while the core price index closely watched by policy-makers at the Federal Reserve rose 0.3 percent. The rise in the core inflation measure was a touch ahead of Wall Street forecasts and the largest one-month rise since October...

According to the consumer spending report, personal income rose 0.8 percent in March, partly reflecting a big pickup in transfer payments from the Medicare health-care program.

Other data were similarly positive.

In a later report, the Institute for Supply Management said its index of factory performance climbed to 57.3 last month from 55.2 in March. Economists had expected little change. A reading above 50 indicates growth in the sector, which -- according to this measure -- has been expanding steadily for nearly three years.

In another report, the Commerce Department said construction spending jumped 0.9 percent in March, more than double expectations, to a record high on the back of soaring outlays on private residential building.

But the Fed may pause anyway, according to another Reuters report.

Federal Reserve leaders on Monday emphasized their determination to keep inflation under control after a key measure of prices rose last month, but hopes for a pause in policy tightening remain intact.

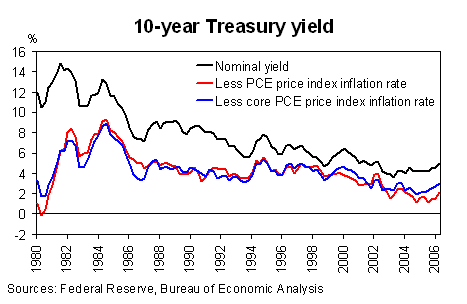

This is despite the fact that real bond yields are still relatively low.

Blog Source - http://skepticalspeculator.blogspot.com/atom.xml

|

| |

|